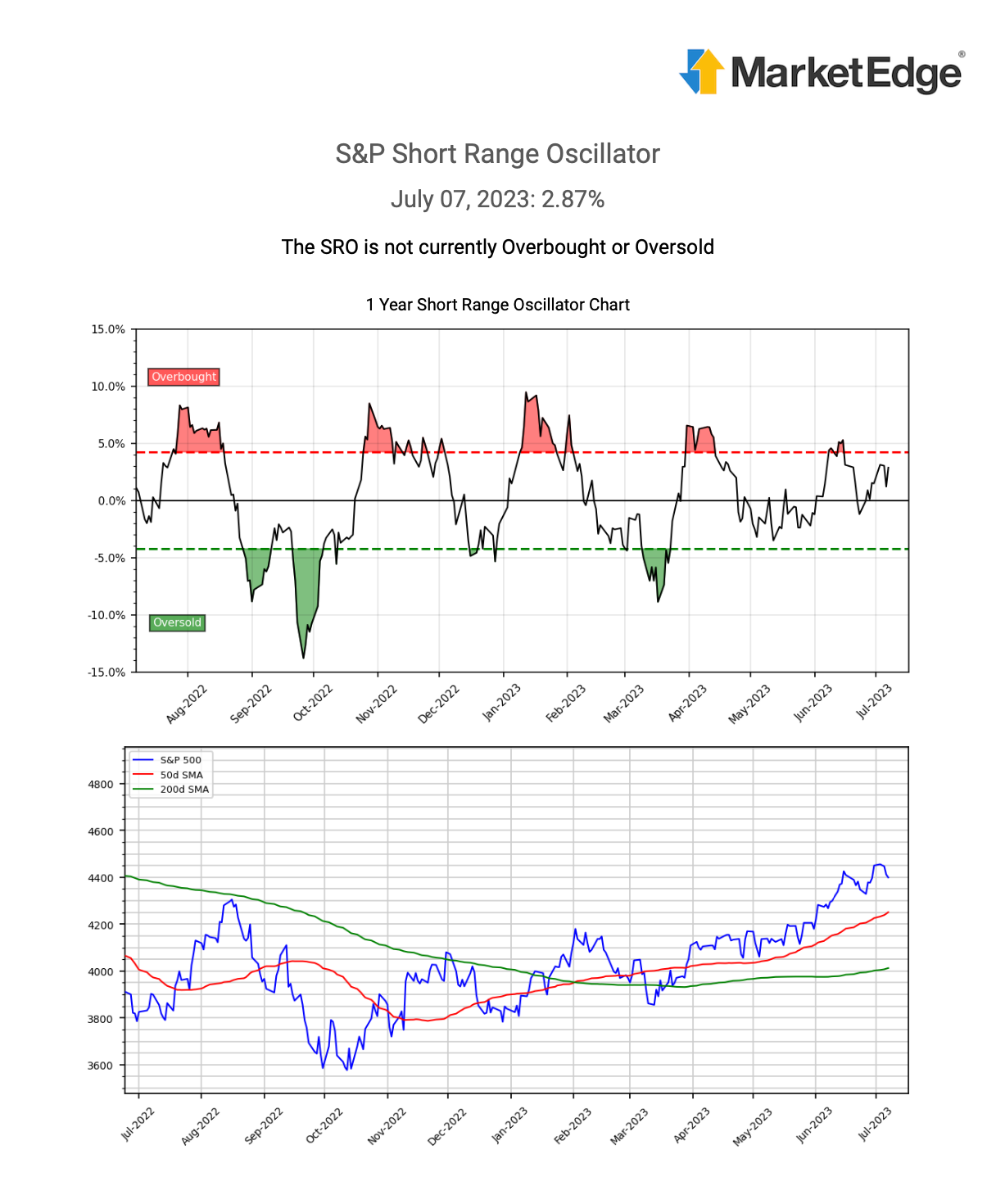

The Oscillator is 'short range' in that the timeframes used in the calculations are all less than 30 trading days, with a stronger emphasis on the most recent 5 and 10 day time frames. The calculations use several broad market indicators when making the calculation including price changes and market breadth. Overbought and Oversold signals (+/-4.0) generally happen several times a year and extremes (+/- 10) are less frequent.